FinTech App Redesign

Synopsis

At MoCaFi, customers had to manage their finances using two separate apps—one for payments from organizations or municipalities (IRC) and another for demand deposit accounts (DDA). This led to frustration, disrupted personalized service, and low conversion rates between the two products.

Recognizing these challenges, I saw an opportunity to streamline the user experience, resolve customer pain points, improve internal data flow, and boost conversions.

I presented a business case with a SWOT analysis, competitive analysis, and a usability research readout to the CEO and leadership team to get the initiative approved.

Role —

Product Manager, Project Manager & Lead Product Designer

Partners —

Ops, Risk, Legal & Complaiance, Product, Dev, Marketing, Sales

Timeline —

1 year

Challenges

Taking on a hybrid role

Product Manager, Project Manager & Lead Product Designer

Building our data warehouse

Either there was no data intake or any of the data we got from vendors was inconsistent.

Using a new codebase

Flutter was new to us, but we wanted to test its capabilities and durability as our current framework wasn't scalable.

Measuring Success

Boosting conversion & driving adoption

Our tracking showed a small percentage of customers converting from IRC to DDA, with fewer than 13,000 actively using the app.

Seamlessly track performance

This will enable the Product team to make recommendations and informed decisions based on insights.

Reduce customer

pain points

Our hypothesis is that if we reduce any friction or pain points, more customers will use the app on a regular basis.

Results

How I did it

Scope of Work

This initiative focused on creating a foundation to enable us to have a scalable app for future products and services. Through collaborative stakeholder engagement, I built the groundwork for a user-centric solution.

Interviews: Key Findings

Having difficulty finding and completing tasks: Customers want to use the app to transact but are having difficulty finding and completing tasks.

Confused about the information presented: Participants expressed an overwhelming sense of confusion about the information shown to them.

Tools and services were not relevant: The features that appeared prominent were not relevant to their current lives.

Access more resources: Participants expressed a desire to have access to more resources like job coaching and financial coaching.

"Through my bank account, you know how you can do a deposit through a check?...I was trying to do a check deposit, but you guys don't have that"

- Participant 1

"

"When I clicked on tabs I was like what is this? Over time I went back to check what it is but I still don't have a grasp on the app. It could be more user-friendly. As a regular college student I didn't know why the information on credit scores and other things were there."

- Participant 2

"

The research team —

Userflows

There are many opportunities for a customer to go down an unintended path. Mapping out the proposed user journey was a great way to ensure we planned for each use case and persona.

Wireframes

Stakeholders for buy-in: I worked cross-functionally to ensure we were aligned on the product strategy and any design decisions based on the pain points collected from the interviews. Then, I began creating low-fidelity wireframes and prototypes for testing.

Testing & Iterations

I conducted unmoderated usability tests for each optimization or net new feature using the UserTesting platform. Based on the results, I had to iterate on the design and retest. Other times, I conducted A/B testing to gauge which design would perform better.

A/B testing the ability to find recent transactions

The test focused on changing the CTA for Recent Transactions.

Result: (A) performed better, with users spending an average of 7 seconds looking for recent transactions, compared to (B), where users spent an average of 65 seconds searching for their recent transactions.

Iterations

I designed a series of navigation bars and ran tests on them to get an idea of what activities are most commonly used by customers who use banking apps regularly. This helped inform what tabs we would place as main nav items in the app.

Result: Most users expressed that they regularly configure their app (settings), look at their balance, and check their transactions. I used these insights to inform the navigation.

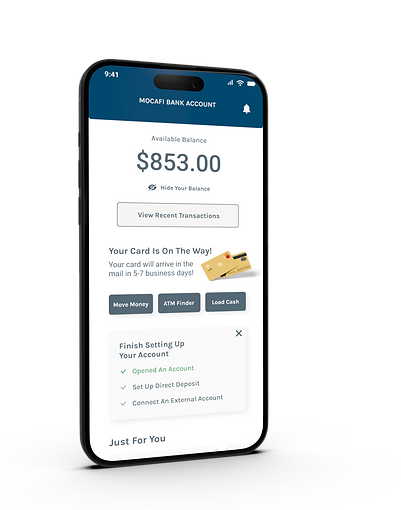

High-fidelity Comps

Once the wireframes were in a good place, I moved on to creating high-fidelity comps, strategically focusing on how the app could be visually designed in a way that would adapt to any client branding while remaining attractive.

Usability

I gave the tasks participants expressed wanting to use the most but were having a hard time finding, prime placement on the home page and navigation.

AI Technology

In order to present relevant and valuable information to customers, we leveraged AI to help us understand what we should show to customers.

Our MVP solution is a short optional question at the end of onboarding that asks the customer to tell us what their goals are. By collecting this information, along with tracking performance and activity, we are able to highlight services and tools that we think the customer may be most interested in.

Marketplace

We heard an overwhelming desire to have access to more resources. I designed a marketplace where customers can access deals, financial coaching, financial education, and events. Over time, the marketplace will grow to host various resources and services.

Self Service Capabilities

To decrease the number of calls to our call center, I worked with our Relationship Managers and Customer Service Managers to inform me of the most frequent requests that could be handled in the app and don’t require authentication or pose a risk.

We were easily able to identify locking/unlocking a card and requesting a replacement card as two (2) new actions we could allow customers to take within the app.

Retention

The (MVP) Spending Summary is a new tool designed to help customers track their expenses and income. The business strategy behind the tool is to use it as an incentive to convert customers from the IRC product to the DDA product.

Also, incentivize customers to enroll in direct deposit to unlock the tools full potential.

The goal is to build this tool to become the go-to place to track finances. Ultimately giving us a way to continue servicing the customer in between transactions.

Design System

From scratch

Though ambitious, I decided to take this time to create our first-ever Design System. We were already doing the work. We just needed to ensure we were thoughtful while creating components. I had a team of designers as my partners in developing and organizing the library and defining the rules and use cases.

Takeaways

Working in a hybrid role gave me a deeper understanding of each department's responsibilities. Once you know what your teammates handle, you start to appreciate all the behind-the-scenes work that, as a designer, I might not usually think about. This project really changed the way our team works together!

I also learned how to better track and organize my work, making it easier for my team to find helpful documents and artifacts. It’s helped me be more thoughtful about handoffs and workflows across departments, making things smoother for everyone.

The team crushin it per usual —